By Edward Yiu

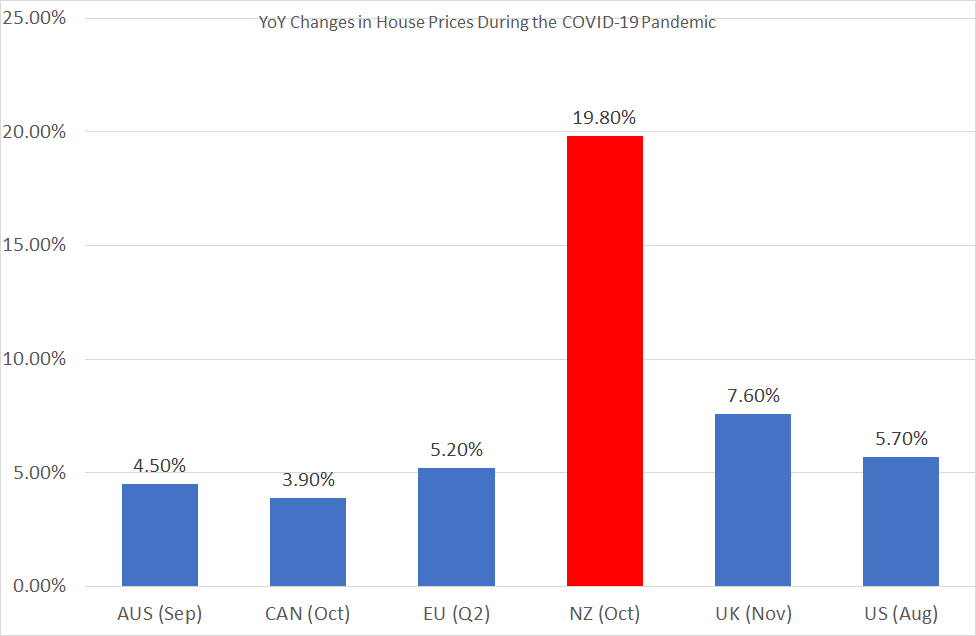

Median housing prices across New Zealand increased by 19.8% year-on-year (YOY) in October 2020. It is one of the largest price surges in the world despite a global COVID recession.

Median housing prices across New Zealand increased by 19.8% year-on-year (YOY) in October 2020. It is one of the largest price surges in the world as shown in Figure 1. However, the sudden common rebound of house prices in most of the developed economies during the pandemic is mind-blowing as the economies are encountering unprecedented recessions. As the rebounds are almost synchronised after the outbreak of the pandemic, it provides a natural experiment to test the alternative hypotheses on the causes of house price changes.

First, Figure 1 compares the latest YOY changes in the house prices of Australia, Canada, European Union, New Zealand, UK and US. All the six economies recorded strong growth in house prices (from 3.9% in CAN, 4.5% in AUS, 5.2% in EU, 5.7% in the US, 7.6% in the UK to 19.8% in NZ). Many of these economies were facing a downward or levelling-off trend of their house prices before the pandemic, but their house prices rebounded like a synchronised switching after the outbreak of the pandemic. This suggests a common cause.

Figure 1: The latest release of Year-on-Year Growth Rates of the House Price Indices During the COVID-19 Pandemic of the six developed economies: Australia (AUS in August), Canada (CAN in October), European Union (EU in Quarter 2), New Zealand (NZ in October), United Kingdom (UK in October), United States (US in August). Sources: AUS-ABS, US-FRED, Others-Trading Economics.

We have heard of many “explanations” for the house price rally in New Zealand. In fact, the four most common suggested reasons in the past are (1) economic growth, (2) insufficient housing supply, (3) migrants and the return of New Zealanders, and (4) monetary policy. But there is no consensus even among policy makers. For example, our Finance Minister Grant Robertson wrote to Reserve Bank Governor Adrian Orr suggesting that it was the monetary policy that caused the surge. Although “Orr admitted that the Reserve Bank’s monetary policy-led decline in interest rates has contributed to a rise in house prices” (Small, 2020), he referred to previous government studies that “housing supply [is] the most significant determinant of house prices” (Beckford, 2020).

Hypothesis 1: Economic Growth

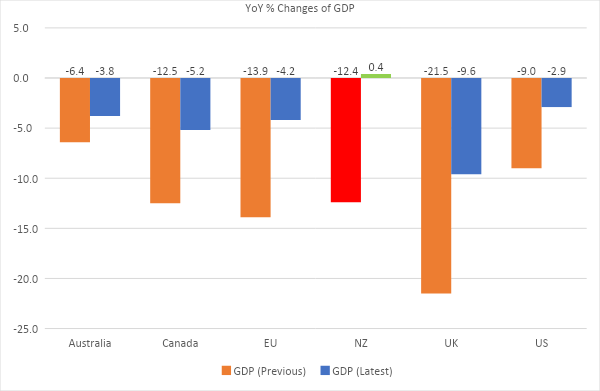

First, the economic-growth hypothesis can largely be refuted as the whole world is facing an unprecedented recession with the deepest YOY plummets of Gross Domestic Product (GDP) in most of the developed countries. Figure 2 indicates a nearly uniform fall in GDP across all the six economies in Q2 and Q3 of 2020, except that New Zealand that got a tiny 0.4% growth in Q3 after a plunge of -12.4% in the previous quarter. The economic repercussions of the coronavirus pandemic are expected to be long-lasting (World Bank, 2020). It makes little economic sense to explain the recent house prices increase by expected GDP growth.

Figure 2: The latest 2 releases (2020Q2, Q3) of Year-on-Year % Changes of GDP During the COVID-19 Pandemic of the six developed economies. Sources: Trading Economics.

Hypothesis 2: Housing Supply

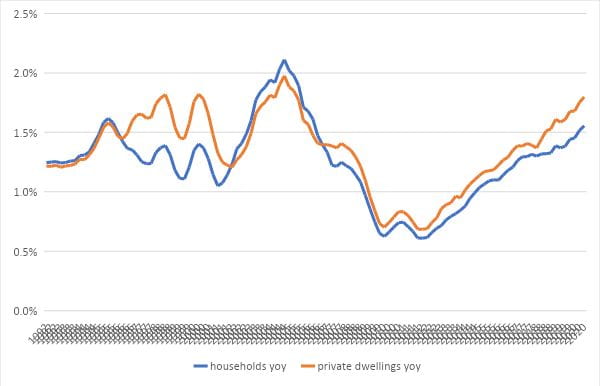

The insufficient-housing-supply hypothesis is also untenable in this cross-country comparison because on one hand it is implausible to contend that suddenly all these developed economies are reverting from over-supply to under-supply at the same time, and on the other hand, New Zealand, for example, has had continuous strong growth in housing supply in recent years. In fact, numbers of new private dwellings have increased continuously since 2012 and the growth rate surpasses that of the increase in number of households, as shown in Figure 3. In the latest statistics, there are 1.9376 million private dwellings accommodating 1.8023 million households at the end of Sep 2020, meaning that there are 7.5% unoccupied (or non-household occupied) dwellings (Stats NZ, 2020a). Better still, the number of new dwellings consented has been increasing from 26,382 in 2015 to 37,981 in 2020 (Year ended Oct figures, Stats NZ, 2020b).

Figure 3: Number of Households YOY versus Number of Private Dwellings YOY, Jun 1992 — Sep 2020. Source: Stats NZ (2020a)

Hypothesis 3: Migrants

Similarly, the migrant hypothesis can also be eliminated by the global comparative study, as the major reason that attracts migrants to return during the pandemic is said to be the success of flattening the COVID curve in New Zealand. In contrast, the situations in the US, UK, Canada, and Europe are still much worse. For example, at the time of this writing, there are 223,570; 20,964 and 6,740 new confirmed cases (on December 10, 2020) in the US, the UK and Canada respectively. The strong increase in house prices in these countries cannot be attributed to migrants returning.

Furthermore, since the Overseas Investment Amendment Act came into effect in late October 2018, non-residents are restricted from buying residential land and existing properties in New Zealand. Stats NZ (2020c) reported that the percentage of residential properties sold to non-citizen or non-resident buyers plunged from 3.3% in Mar 2018 to 0.6% in Sep 2020, and is now less than their sellers (Figure 4).

Figure 4: Home Transfers by Non-Citizen or Non-Resident (NCNR) Buyers and Sellers, Mar 2017 —Sep 2020. Source: Stats NZ (2020c)

Hypothesis 4: Real Interest Rate Hypothesis

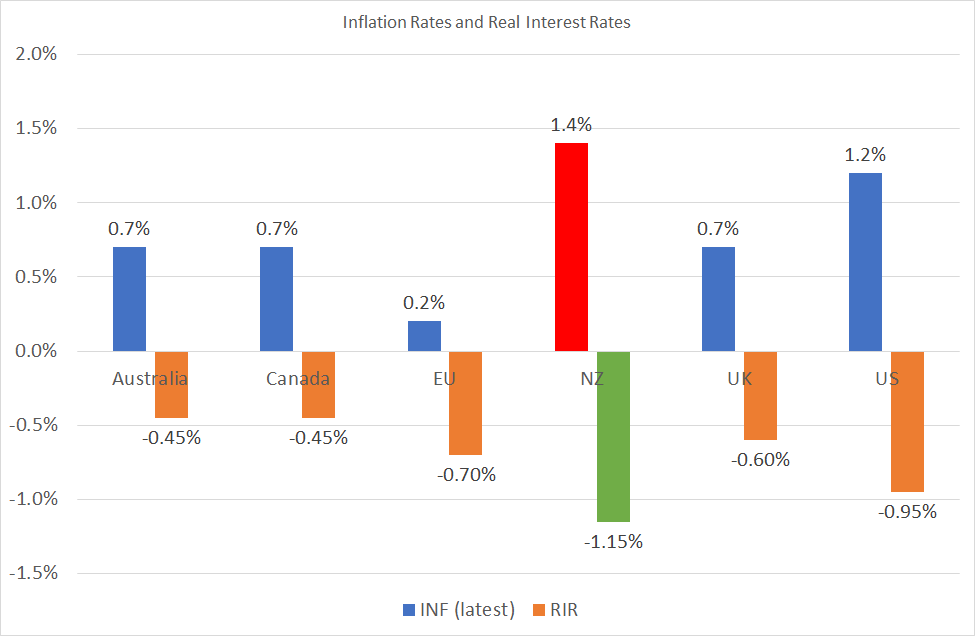

In contrast, cutting interest rates (to historic lows) is a synchronised response of most of the central banks to COVID-19 (Kingsly & Henri, 2020). Deloitte (2020) reported the central banks’ interest rate cuts in some of the developed countries in early 2020. For example, the US, Canada, Australia and New Zealand’s central banks have cut their interest rates to 0.25%, whereas the UK and EU’s cut and kept their interest rates to 0.1% and -0.5% (Figure 5).

Figure 5: Changes in interest rates before (IR_bef) and during (IR_dur) the pandemic, source: Deloitte (2020)

In fact, the Reserve Bank of New Zealand reduced its interest rate by 0.75% in one go, and also removed the mortgage loan-to-value ratio restrictions at the same time. With the house price rebounds in recent months, the Reserve Bank of New Zealand proposes reinstating the mortgage restrictions (RBNZ, 2020). It implies an agreement that the house price soar is triggered by the monetary and mortgage policies.

After cutting interest rates, the world seems to revert to the inflation track. The inflation rate of Australia went up from -0.3% to +0.7% in Q2-Q3. That of the United States and New Zealand have levelled at 1.2% and 1.4% (Figure 6). When their inflation rates gradually surpass the interest rates, it results in a negative real interest rate (excluding risk premiums) regime (Figure 6) and causes asset price rallies. With the highest inflation rate, the real interest rate of New Zealand becomes the most negative one among the six economies.

Figure 6: The latest inflation rates (INF) and real interest rates (RIR) of the 6 economies (because the data is released on different dates, the data is not from the same month). Source: Trading Economics

Cutting interest rates may not be able to save the “Main Street” (the real economy), but it can cause a “Wall Street” (asset market) rally. It is commonly agreed that “cheap loans and looser lending requirements designed to stimulate the economy during the pandemic have attracted investors back into the market” (Taylor, 2020) Theoretically when “unlimited credit and money flows into an inherently finite supply of property, [it] causes rising house prices …” (Ryan-Collins, 2018) This is the second natural experiment since the Global Financial Crisis in 2008. The experiments of implementing abnormally low interest rates by the central banks have been shown to drive property prices upward. In the first experiment, it was the US sub-prime mortgage crisis and then the European debt crisis that triggered the interest rate cuts. This time, it is caused by the COVID pandemic, which drags the global economy into a recession. An expansionary monetary policy is taken as the cure. The “success” in the first experiment boosts the confidence of the central banks to cut interest rates more aggressively in this round.

In fact, since the US Federal Reserve commenced its normalisation of the interest rate process five years ago, property prices in many countries levelled-off or fell just before the pandemic. Among them, the house price decline in Australia was obvious, which was agreed to be closely related to the central bank’s policy of tightening mortgages. Then when the interest rate was cut to an historic low in early 2020, the house prices went up again. This kind of switching on-off test (interventional approach) across different countries provides more convincing evidence than either a cross-section analysis or a time series test. It also acts as a critical test of the four alternative hypotheses.

References:

Beckford, G. (2020) Reserve Bank rejects request for help fixing the housing crisis, RNZ, 11 Dec.

Deloitte (2020) COVID-19-The impacts on global residential mortgage markets, May.

Kingsly, K. & Henri, K. (2020) Central Banks Respond to COVID-19 to Stave off a Financial Crisis, They Need for Targeted Fiscal Measures Should not be Understated, SSRN. https://ssrn.com/abstract=3562320

RBNZ (2020) Reserve Bank proposes reinstating LVR restrictions, 8 Dec. https://www.rbnz.govt.nz/news/2020/12/reserve-bank-proposes-reinstating-lvr-restrictions

Ryan-Collins, J. (2019) Why can’t you afford a home? Cambridge, UK: Polity Press.

Small, Z. (2020) Reserve Bank Governor Adrian Orr recommends new housing agency to coordinate response to rising house prices, Newshub, 11 Dec.

Stats NZ (2020a) Dwelling and household estimates: Sep 2020 quarter, Stats NZ, 7 Oct.

Stats NZ (2020b) Building consents issued: October 2020, Stats NZ, 3 Dec.

Stats NZ (2020c) Property transfer statistics: September 2020, Stats NZ, 30 Oct.

Taylor, P. (2020) New Zealand house prices soar despite Covid recession, worsening affordability crisis, Guardian, Oct 29. https://www.theguardian.com/world/2020/oct/29/new-zealand-house-prices-soar-despite-covid-recession-worsening-affordability-crisis

World Bank (2020) COVID-19 will leave lasting economic scars around the world, World Bank Blogs, 8 Jun.

Edward Yiu is an Associate Professor in Property at the University of Auckland.

Disclaimer: The ideas expressed in this article reflect the author’s views and not necessarily the views of The Big Q.

You might also like:

Q+A: Boom or bust: What is the state of housing in New Zealand?

Why is housing so unaffordable?